Waahe Capital Strategy

Our vertically integrated business model eliminates multiple middlemen and markups, helping keep our costs down and return on investments high. We source best-in-class materials through our global supply chain so the Waahe construction team can create quality properties and sound investments.

Waahe Capital Business Model

We are extremely conservative in our underwriting, and we only bid on properties that pass the stringent conservatism test. Even when the markets were achieving over 20% YoY rent growth, we were underwriting at a conservative 3% rent growth.

Our Asset Management team constantly evaluates and prioritizes the most impactful projects to stack wanted amenities on top of our beautifully renovated units. This helps to maximize revenue and to unlock untapped revenue from the existing amenities and features.

Our in-house property management team executes the revenue optimization plans. Since they are part of the same team under Waahe as asset management and redevelopment, the PM team is extremely nimble in executing the day-to-day changes to the market and delivery of renovated units.

With our in-house team, we source best-in-class materials along with a defined renovation process, we are able to convert ordinary units into beautiful homes that tenants want to live in. These finished units are the most in-demand units in the market.

Manufacturers

Manufacturers Mark-upDistributors

Mark-upDistributors Mark-upDealers/

Mark-upDealers/

Retailers Mark-upSubcontractors

Mark-upSubcontractors Mark-upGeneral

Mark-upGeneral

Contractor Mark-upProperty

Mark-upProperty

management

REAL ESTATE

REAL ESTATE

INVESTMENT CO. Investors

Investors

-

Manufacturers

Manufacturers

-

DistributorsMark-up

DistributorsMark-up -

Dealers/ RetailersMark-up

Dealers/ RetailersMark-up -

SubcontractorsMark-up

SubcontractorsMark-up -

General ContractorMark-up

General ContractorMark-up -

Property managementMark-up

Property managementMark-up -

REAL ESTATE INVESTMENT CO.

REAL ESTATE INVESTMENT CO.

-

Investors

Investors

5x savings!

Waahe Acquisition Criteria

Our Investment Strategy

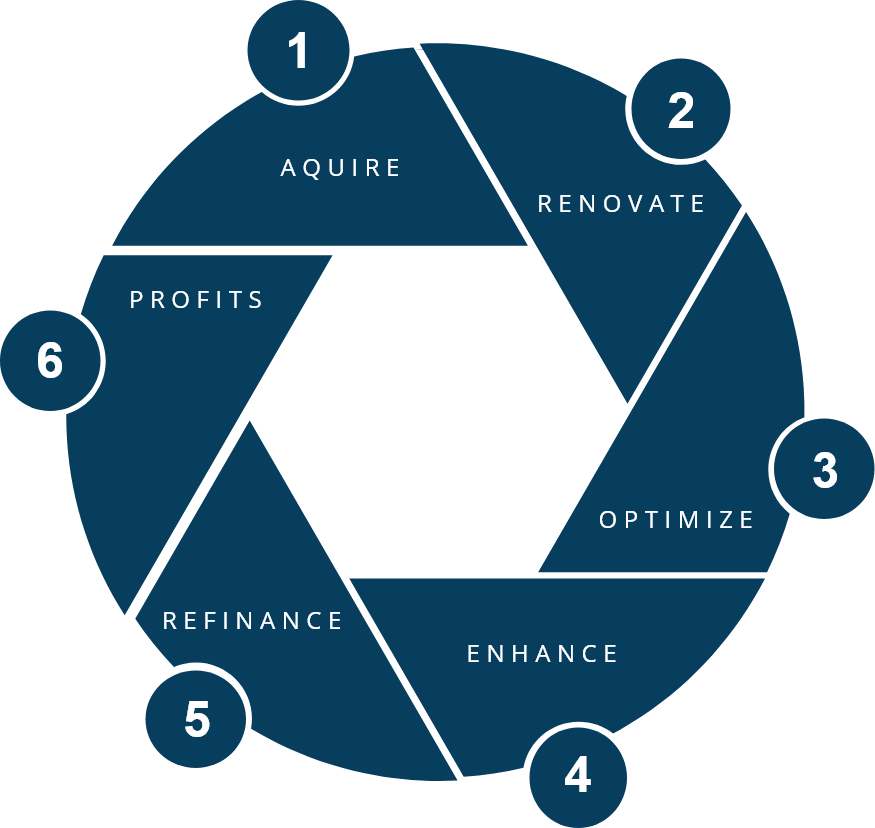

We’ve streamlined our business model down to six comprehensive steps. We put careful consideration into each step so we can do what’s right. By applying the Lean Six Sigma principles, we’ve established a standard in design and scalable processes.

We leverage our Global Supply Chain network, which aids in overall cost control, quality, and timelines.

Acquire

Find good real estate deals at

optimal locations.

Renovate

Complete exterior renovation

and rebranding.

Optimize

Increase occupancy and setting appropriate rent prices.

Enhance

Make value-add improvements

with interior renovations.

Exit

Sell or refinance the property.

Profits

Distribute equity share of profit

to investors.

Acquire

Find good real estate deals at

optimal locations.

Renovate

Complete exterior renovation

and rebranding.

Optimize

Increase occupancy and setting appropriate rent

Enhance

Make value-add improvements

with interior renovations.

Exit

Sell or refinance the property.

Profits

Distribute equity share of profit

to investors.

Case Study Download

Want more information about our projects? Download our case study of an actual project and see the results of our step-by-step process.

Investment FAQs

Our Knowledge Center

We’re happy to answer any questions you may have regarding our process. Feel free to reach out at any time.

Back to top

Join the Waahe Investor Group

Join the most innovative, efficient and profitable multi-family investment private equity company in the U.S.

Our Knowledge Center

We’re happy to answer any questions you may have regarding our process. Feel free to reach out at any time.

Join the Waahe Investor Group

Join the most innovative, efficient and profitable multi-family investment private equity company in the U.S.